18th plenary meeting

The 18th plenary meeting of the Household Solar Funders Group took place on Thursday the 9th of October, 2025.

List of participants

Meeting minutes

Update from the HSFG coordinator

HSFG coordinator Wim Jonker Klunne opened the 18th plenary meeting of the Household Solar Funders Group by welcoming all participants and introducing the agenda.

The Household Solar Funders Group, established in 2020 to strengthen coordination in the off-grid solar sector, has grown to 63 member organisations but is currently facing funding challenges. Following the end of AECF’s financial support in 2024, the Group is currently operating on a voluntary basis while exploring new funding opportunities and potential partnerships or mergers with other initiatives. Despite a small drop in membership due to organisational changes, engagement remains strong. The Chair proposed conducting a sector-wide review—supported by the Energy Saving Trust—to assess coordination needs and shape a sustainable long-term strategy. In the interim, the Group aims to maintain its current activities, including meetings, newsletters, and its website, while seeking short-term financial support.

The meeting opened with an update on membership of the Household Solar Funders Group, which has declined slightly due to staff changes within member organisations and the closure of USAID and the Power Africa initiative. Despite this, engagement remains strong, with over 40 participants attending the current meeting.

The Group was established in 2020, initially hosted by the Shell Foundation with co-funding from USAID. In mid-2023, hosting responsibilities were transferred to the Africa Enterprise Challenge Fund (AECF) under the REACT programme, supported by the Swedish International Development Cooperation Agency (Sida). Since its inception, membership has grown from the original target of 20 organisations to 63, demonstrating the strong demand for coordination and knowledge exchange within the off-grid solar sector. Activities have included plenary meetings, thematic working groups, the creation of a members’ activities database, a dedicated website, and in-person networking events alongside industry gatherings.

However, the Group has been without external funding since the end of 2024. AECF was unable to continue financial support for 2025, and while discussions with several potential funders have taken place, none have yet resulted in new commitments. Current operations—including the website, newsletters, and meetings—are being maintained voluntarily by the Chair to ensure continuity. Conversations are ongoing about possible collaboration or integration with other sector coordination initiatives, but outcomes remain uncertain.

Following the meeting reminder of earlier this the week, highlighting the funding challenges, several members have expressed interest in exploring ways to sustain the Group, and preliminary discussions on potential funding are now under way. In the longer term, the Chair proposed a broader review of the coordination needs within the sector to identify the most effective way forward. The Energy Saving Trust has offered to assist with a survey to assess these needs and to help develop a potential sector coordination strategy that avoids duplication and maximises value for participants.

In the short term, the Chair hopes to maintain the Group’s current level of activity—through its website, newsletters, and regular meetings—while seeking interim funding or donations. Members who may be able to offer support are invited to reach out directly for further discussion.

All documents, including the recordings and presentations of the current meeting, are available at the members-only section of the HSFG website.

Wim's presentation

Update on ASCENT implementation

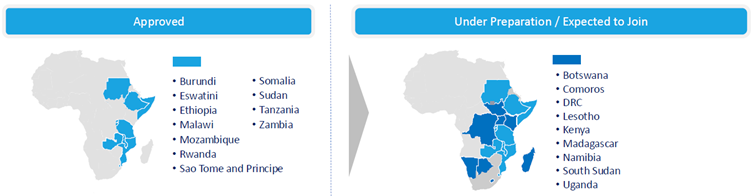

Dana Rysankova of the World Bank provided an update on the ASCENT Program, its flagship initiative for expanding electricity access in Eastern and Southern Africa and a key delivery mechanism for the Mission 300 goal of reaching 300 million Africans by 2030. ASCENT aims to connect 100 million people, half through distributed renewable energy such as solar home systems and mini-grids, backed by US$5 billion in World Bank financing and an expected US$10 billion in leveraged co-funding. Implementation is underway across multiple countries, with all operations to be launched by 2026. The programme combines national projects with regional facilities coordinated through COMESA and the Trade and Development Bank, focusing on results-based financing, technical assistance, and new instruments such as equity, credit lines, and risk-sharing mechanisms. Emphasis was placed on policy reform, private sector support, and partnership opportunities to ensure sustainability and accelerate access to modern energy services across the region.

Mission 300 is a joint World Bank and African Development Bank initiative to provide electricity access to 300 million Africans (250 million by the World Bank). ASCENT is the main delivery mechanism for Mission 300 in Eastern and Southern Africa.

The goal of ASCENT is to provide 100 million people access to electricity by 2030. Roughly half via distributed renewable energy (DRE) solutions (mainly solar home systems and mini-grids).

ASCENT is funded through US$5 billion from the World Bank, targeting an additional US$10 billion leveraged from partners and private sector.

ASCENT has three pillars:

1. Grid electrification

2. Off-grid electrification

3. Enabling environment, including DRE, clean cooking, and productive use

Countries request national programmes, tailored to their specific conditions. Most programmes include both grid and off-grid components, though some are specialised.

ASCENT includes regional initiatives to ensure countries are connected and supported. The COMESA Technical Assistance Facility promotes knowledge exchange (e.g. the recent ASCENT Week in Lusaka), policy and regulatory improvement, and capacity building.

The following facilities exist under ASCENT:

a. Results-Based Financing (RBF): many Sub-Saharan countries already have RBF programmes; about half are under ASCENT. The “Pre-ASCENT” RBF programmes (approved before 2024) are being integrated into ASCENT, while a regional RBF is being developed to fill gaps where national programmes are absent or have ended, preventing market collapse. This is piloted with ESMAP funding, with additional GCF funding expected (approval sought March 2026).

b. Trade and Development Bank (TDB): the World Bank lends to TDB, which on-lends to private sector companies (through their non-profit arm the Trade and Development Fund (TDF))

c. Private Sector Technical Assistance Facility managed by COMESA, which is currently recruiting a facility manager. This facility works with GET.invest to help DRE and clean cooking firms reach financial closure faster.

d. Zafiri Facility: a joint initiative between TDB, IFC, and the World Bank to provide equity financing for energy access companies. This is nearing operationalisation with a fund manager appointed.

e. Risk-Sharing Facility (in design): aims to de-risk local financing, including guarantees for local banks and mechanisms for carbon revenue price floors.

Dana closed by emphasising partnership opportunities with organisations and programmes with similar objectives to align or co-finance activities under ASCENT.

During the Q&A Dana elaborated on the ASCENT activities in Mozambique in response to a question by Chris Thompson.

Dana's presentation

Making PAYGo Profitable

Willem Nolens of the PayGo Lab highlighted the unsustainable state of the PAYGO solar sector, where low repayment rates and weak governance prevent most firms from achieving profitability. He attributed this to misaligned incentives between sales and credit management, and to the absence of regulation and transparency in what is effectively a financial service industry. To address these issues, he proposed unbundling sales and credit operations, bringing PAYGO lending under regulatory oversight, and establishing industry-wide benchmarking. Initiatives such as Owazi and the In24 pilot are already testing these solutions, and Willem called on funders to back the transition towards a regulated, sustainable micro asset finance industry.

Willem Nolens began by describing the current state of the PAYGO solar sector. Each year, the industry sells about three million solar home systems on credit, excluding cash sales. Yet data from 24 companies show that repayment rates average only 71 percent—far below sustainable levels. In practice, firms recover just seven of every ten dollars lent. Although some achieve repayment rates above 90 percent, proving profitability is possible, most remain loss-making even under improved PAYGO 2.0 models, pointing to deeper structural weaknesses.

He identified two main causes of this underperformance: misaligned incentives and weak governance. At customer level, payments are often seen as optional rather than as binding loan obligations. At company level, short-term sales goals conflict with the need for long-term credit discipline. While sales boost immediate cash flow, sound credit management ensures lasting viability; this tension undermines repayment and profitability.

Governance is another major challenge. Despite operating as de facto financial service providers, PAYGO firms largely remain unregulated, leaving consumer protection and credit standards weak. Limited transparency compounds the problem, as there is no consistent, public benchmarking of repayment or credit performance across companies.

To address these issues, Willem proposed structural and regulatory reforms. He recommended separating sales and credit operations so that distribution companies focus on sales while newly regulated micro asset finance companies manage loan portfolios. This would resolve the sales–credit conflict and enable proper oversight and consumer protection.

He also called for central bank supervision of PAYGO as a financial service and for industry-wide benchmarking to strengthen transparency and accountability. Two initiatives are already pursuing these goals. Owazi is a data platform comparing repayment performance across companies, shifting attention from sales volumes to credit quality. The “In24” pilot, operating in Malawi, Mozambique, and Uganda, is testing the unbundled model by taking over PAYGO loan portfolios to demonstrate improvements in repayment, regulation, and financial health.

Willem concluded with a call to action for funders. He urged them to recognise that the current PAYGO model is unsustainable and to support the creation of a regulated micro asset finance industry as a new asset class. Funders should encourage companies to unbundle, back initiatives such as Owazi and In24, and provide grants and patient capital to ease balance sheet pressures and enable a sustainable transition.

In the following discussion, Alix Graham of Cygnum and Drew Corbyn of GOGLA referenced the PAYGo PERFORM KPIs, while Ryan mentioned a GOGLA report that has a breakdown on the latest data and KPIs.

Aaron Leopold mentioned that his company EnerGrow, a PUE asset finance company in Uganda has been doing this unbundled model for the past 6 months. They are now acting as a BNPL (Buy Now Pay Later) partner for PUE and e-cooking retailers. He does see this as the future, but noted the challenge that investors don't know what to do with this yet - new model, needs new proof points, and those aren't there yet.

Willem's presentation

Update on the IKEA Foundation strategy

Presentation by Jolanda van Ginkel of the IKEA Foundation.

The IKEA Foundation’s strategy reflects a thorough review process focused on flexibility, local impact, and responsiveness. It maintains a core emphasis on emission reduction with direct social benefits, centred on people, while continuing work in Kenya, Uganda, Ethiopia, and India and expanding to Brazil and Indonesia. The strategy concentrates on three interconnected thematic areas—energy, land, food & forests, and buildings & transport—while integrating cross-cutting principles such as systems change, local leadership, and inclusive partnerships. Impact measurement will shift toward system-level indicators, and the implementation approach combines capital mobilisation, market development, policy influence, and narrative shaping. Overall, the strategy represents a shift from fragmented projects toward coherent systems transformation, building on the Foundation’s existing strengths and partnerships.

The IKEA Foundation developed its strategy through an extensive review process, drawing on reflection, learning from partners, expert convenings, and grantee perception surveys. A central question guiding this process was how the Foundation “shows up” as a philanthropy, ensuring flexibility, responsiveness, and local impact.

The Foundation’s core focus remains on reducing emissions while generating direct social benefits, with people at the centre of all interventions. Geographically, the strategy maintains work in existing countries—Kenya, Uganda, Ethiopia, and India—while expanding into Brazil and Indonesia.

The strategy concentrates on three interlinked thematic areas. In energy, the Foundation will continue its work on energy access and productive use, while broadening efforts to include renewable infrastructure, grid decarbonisation, and context-specific solutions. In land, food, and forests, priorities include advancing regenerative agriculture, protecting forests, and reducing food loss and waste, particularly in new geographies such as Brazil. In buildings and transport, the Foundation seeks to promote clean heating and cooling, circular construction, and electric mobility. These areas are connected, particularly through initiatives linking energy access and agricultural systems.

Cross-cutting themes guide the Foundation’s approach, emphasising the integration of people and climate considerations across all initiatives, adopting a systems change lens attentive to local contexts and power dynamics, and strengthening local leadership through proximate, inclusive partnerships.

In measuring impact, the Foundation intends to shift from narrow key performance indicators toward system-level signals, including policy adoption, changes in financial flows, and the strengthening of local institutions. Its implementation “toolbox” includes increasing capital flows, exploring impact investment, building markets, supporting local entrepreneurs, influencing enabling policies and governance frameworks, shaping narratives to counter misinformation, and ensuring coordinated, localised funding.

Jolanda's presentation

Member updates

Chris Emmott of Acumen mentioned the close of $245m for their Hardest-to-Reach Initiative (H2R) focusing on first time energy access across 17 hard to reach markets (announcement), and a $90m in committed capital to Kawasafi 2, which is an equity vehicle focused around energy access and the green transition (announcement).

Gavriel Landau of Charm Impact mentioned an imminent announcement of them launching their first debt fund targeting early stage locally owned companies. They are actively looking for new investors in this fund. He is very open to discuss pipeline with other members that are looking for companies.

Drew Corbyn of GOGLA informed the meeting that next year’s Global Off-grid Solar Forum and Expo will be held in Rwanda, in October. He asked members to reach out with ideas on session, side-events and to discuss sponsorship opportunity, and to complete this short survey.

Drew also mentioned their report on blended finance for off grid solar with details on seven blended finance instruments, and alerted the members on the recently formed large Agri Energy Coalition, a global alliance of partners working on energy, water, agriculture, nutrition, climate and finance; created to unlock the potential of agri-food systems with clean energy.

Alix Graham of Cygnum Capital did give the meeting a heads up that they are in the process of bringing on a new fund Into the Signum group. This will continue the mandate of the Off-grid Energy Access Fund by investing in solar home systems.

James Smith of REEEP announced that their SOARING programme on support to finance institutions in Tanzania and Zambia recently did their first loan under the credit guarantee to an e-mobility company in Tanzania (via a micro-finance institution supported by ICICI).

He also mentioned that they are very close now to completion of the evaluation of the applications on the first call for proposals of their productive use in renewable energy PURE growth fund in in Tanzania.

Chianda Njogu of GEAPP mentioned their Powering People and Planet report, which was launched at the Climate Week in New York. There they also unveiled veiled the Energy and Opportunity Coalition, which is a new initiative targeting 100 million jobs and improved livelihoods by 2035.

Sandra Lutaaya of PFAN alerted the meeting that they currently working on a new funding initiative. They intend to launch a new equity fund, probably Q1 next year, with a focus on different technologies in clean energy, sustainable infrastructure and climate smart solutions.

Closure

HSFG coordinator Wim Jonker Klunne closed the meeting at 15:25 SAST, reminding the members of his plea during the introduction for any member that will be able to financially support the Group to contact him.